Health insurance is an essential aspect of maintaining well-being and financial stability. Navigating the complex landscape of health insurance plans can be daunting, but in 2024, obtaining free, fast, and easy health insurance has become more accessible than ever. Let’s explore how HealthCare.gov, UnitedHealthcare, and YourInsurancePath.com are making health insurance more accessible than ever before. In this blog post, we’ll guide you through finding the best health insurance plans that suit your needs without breaking the bank.

YourInsurancePath: Free-Fast and Easy Insurance

YourInsurancePath.com is revolutionizing the health insurance experience by offering free, fast, and easy plans tailored to your needs. With a focus on user-friendly interfaces and quick application processes, they’re removing the barriers that often complicate getting insured. They understand that every individual’s health needs are different and provide personalized plans to match those needs.\

How Does YourInsurancePath Work?

YourInsurancePath.com works by simplifying the process of finding and applying for health insurance. Here’s a breakdown of how the platform operates:

1. Assessment of Needs: Users start by assessing their health insurance needs, considering factors like budget, health conditions, and preferred coverage.

2. Plan Comparison: The platform offers tools to compare different health insurance plans. Users can view various options side-by-side, considering premiums, benefits, and coverage limits.

3. Instant Quotes: By entering some basic personal information, users can receive instant quotes for various health insurance plans without any obligation.

4. Expert Advice: YourInsurancePath.com provides access to Insurance Experts who can offer guidance and answer questions, ensuring users make informed decisions.

5. Educational Resources: The site includes a wealth of educational materials to help users understand the intricacies of health insurance policies.

6. Application Process: Once a user selects a plan, the application process is streamlined and can be completed directly through the website.

7. Customer Support: After enrollment, YourInsurancePath.com offers ongoing support to help with any questions or changes to the policy.

The platform is designed to make the experience of obtaining health insurance as effortless and transparent as possible, catering to the needs of a wide range of consumers looking for suitable health insurance coverage in 2024.

How to Use YourInsurancePath?

Using YourInsurancePath.com is designed to be straightforward and user-friendly. Here’s a step-by-step guide on how to navigate the platform:

- Visit the Website: Start by going to YourInsurancePath.com.

- Explore Insurance Options: Browse through the different Health Insurance Plans available on the platform. You can compare various plans to see which one suits your needs.

- Get a Quote: Enter your details to get a customized quote. This typically includes information like your age, location, and medical history.

- Apply for Coverage: Once you’ve chosen a plan, you can apply directly through the website. You’ll need to fill out an application form with more detailed information.

- Review and Submit: Review all the information you’ve provided, make any necessary edits, and then submit your application.

- Wait for Approval: After submission, YourInsurancePath.com will process your application. You’ll receive a notification once your application is approved.

- Manage Your Policy: Once you’re insured, you can manage your policy through the platform. This includes viewing your coverage details, updating personal information, and filing claims.

Remember, if you need assistance at any point, customer support is available to help you navigate the process. For more detailed instructions or help with specific features, you can check out their resources or contact YourInsurancePath directly. If you have any more questions or need further assistance, feel free to ask!

UnitedHealthcare: Expanding Access to Care

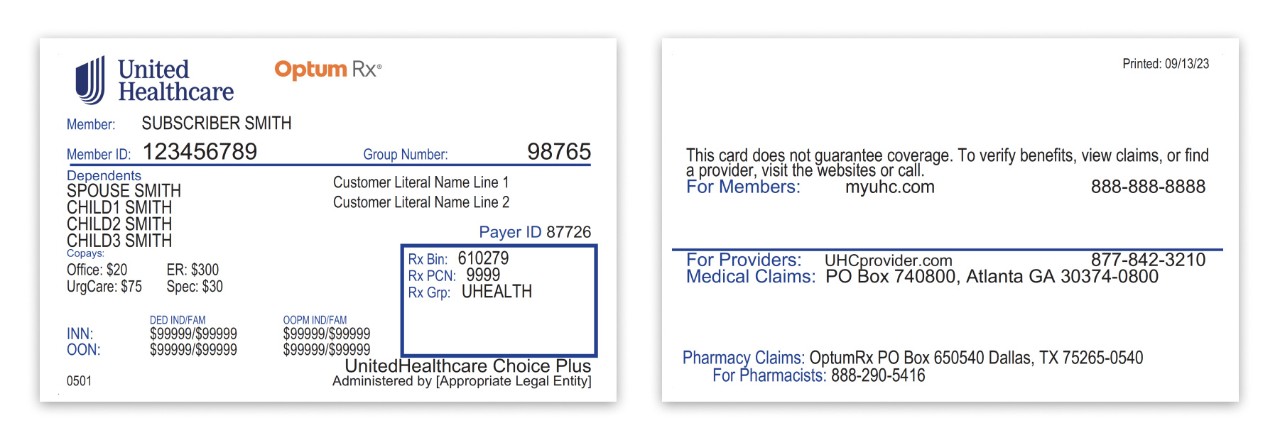

UnitedHealthcare is offering individual and family plans on the Health Insurance Marketplace in 26 states for 2024. Their plans feature $0 unlimited primary and virtual urgent care, prescriptions as low as $5, and up to $100 in reward incentives. They’re expanding their offerings into four new states, bringing affordable benefits to more than 60% of the eligible population. With UnitedHealthcare, you can enroll during the open enrollment period and enjoy a wide range of benefits designed to make healthcare more accessible.

How Does UnitedHealthcare work

UnitedHealthcare operates as the health benefits segment of UnitedHealth Group, which is a diversified healthcare company. Here’s a basic overview of how UnitedHealthcare works:

1. Health Insurance Plans: UnitedHealthcare offers a variety of health insurance plans for individuals, families, and employers. These plans are designed to meet different needs and budgets, providing coverage for Healthcare Services and treatments.

2. Preventive Care: Many UnitedHealthcare plans cover preventive care services, which may include regular check-ups, screenings, and vaccinations. The goal is to remain healthy and avoid illness.

3. Network of Providers: UnitedHealthcare has a large network of healthcare providers, including doctors, specialists, and hospitals. This allows members to receive care from a wide range of professionals.

4. Member Resources: Members have access to various resources, such as online account management, where they can review their coverage, find in-network providers, and track claims.

5. Customer Support: UnitedHealthcare provides customer support to help members understand their benefits, choose the right plan, and resolve any issues related to their coverage.

6. Health Savings Accounts (HSAs): Some plans are compatible with Health Savings Accounts, which allow members to save money tax-free for eligible healthcare expenses.

7. Technology Integration: UnitedHealthcare utilizes technology to streamline processes, making it easier for members to access information and manage their health care.

UnitedHealthcare’s mission is to help people live healthier lives and to help make the health system work better for everyone by improving access, affordability, outcomes, and experiences. If you’re considering UnitedHealthcare, it’s important to review the specific details of the plans available to you, as coverage and benefits can vary. If you have more questions or need further assistance, feel free to ask!

How to Use UnitedHealthcare?

Using UnitedHealthcare is convenient and user-friendly. Here’s a simple guide on how to utilize their services:

1. Register: Go to myuhc.com and select ‘Register now’. Follow the step-by-step instructions to create your account.

2. Download the App: For easy access to your health plan details, download the UnitedHealthcare app on your mobile device. This app provides instant access to manage your health plan details, get member ID cards, and more.

3. Access Your UCard: If you have a UnitedHealthcare UCard®, it serves as your member ID and gives you access to a large network of providers, as well as benefits like credits for healthy food, OTC products, and utilities.

4. Find Care and Pricing: Use the app or website to search for network providers, see ratings and reviews, and estimate out-of-pocket costs for different types of visits.

5. Check Benefits and Coverage: You can find copay and coinsurance amounts, view plan spending, and see how your plan covers different types of care and services.

6. Refill Prescriptions: Request refills right from the app look up drug prices and search for pharmacies near you.

7. View Claims: Check the status of new and past claims, see the amount billed, what your plan paid, and how much you owe.

8. Virtual Care: If your plan includes this benefit, you may be able to schedule a virtual visit for urgent care, routine care, and more.

For more detailed instructions or help with specific features, you can view step-by-step instructions for common tasks within the app or website. If you need further assistance, UnitedHealthcare’s customer support is available to help you navigate the process. If you have any more questions or need further assistance, feel free to ask!

The Future of Health Insurance

The Health Insurance landscape is changing, and these platforms are leading the charge. They’re making it easier for everyone to find and enroll in plans that offer comprehensive coverage without the high costs. With technology-driven solutions and a community of support, they’re ensuring that you have the resources you need to make informed decisions about your health coverage.

Conclusion

In 2024, getting health insurance doesn’t have to be complicated. With HealthCare.gov, UnitedHealthcare, Aetna, and YourInsurancePath.com, you have access to plans that are free, fast, and easy to understand. These platforms are committed to providing you with the coverage you need, with the convenience and affordability you deserve. Explore your options today and take the first step towards a healthier future.

FAQ’s

Certainly! Here are some frequently asked questions (FAQs) for YourInsurancePath and UnitedHealthcare:

YourInsurancePath FAQs

1. How do I sign up for a plan on YourInsurancePath?

Visit the website, browse through the available plans, and choose one that fits your needs. You can then apply directly online.

2. What types of insurance plans are available on YourInsurancePath?

YourInsurancePath offers a variety of health insurance plans tailored to different needs, including individual, family, and group plans.

3. Can I compare different plans on YourInsurancePath?

Yes, the platform allows you to compare different plans to help you make an informed decision.

4. Is customer support available if I have questions?

Yes, YourInsurancePath provides customer support to assist you with any inquiries you may have.

UnitedHealthcare FAQs

1. How do I find a network doctor or hospital with UnitedHealthcare?

You can use the online directory on UnitedHealthcare’s website or app to find network providers.

2. What services are covered by my UnitedHealthcare plan?

Coverage details can be found by logging into your health plan account or contacting customer support.

3. Do I need a referral to see a specialist with UnitedHealthcare?

This depends on your specific plan. Some plans require referrals, while others do not.

4. What is prior authorization and do I need it with UnitedHealthcare?

Prior authorization is a requirement for certain services to be approved before you receive them. Check your plan details or contact customer support to find out if you need prior authorization.

5. How can I manage my prescriptions with UnitedHealthcare?

UnitedHealthcare offers pharmacy benefits, and you can manage your prescriptions through their website or app.

For more detailed information or additional questions, you can visit the respective websites of YourInsurancePath and UnitedHealthcare or reach out to their customer service teams. If you have any other questions or need further assistance, feel free to ask!

People Also Asked

Certainly! Here are some of the most frequently asked questions about health insurance:

1. How does health insurance work?

Health insurance is designed to help cover the costs of medical-related expenses. You pay a monthly premium, and in return, the insurance company provides coverage that helps pay for services like doctor’s visits, hospitalizations, surgeries, and prescriptions.

2. How much does a health insurance plan cost?

The cost of health insurance varies based on factors such as location, age, tobacco use, and the type of coverage you purchase. It includes the premium, deductible, copays, and possibly coinsurance.

3. Which health insurance plan is best for me?

The best health plan depends on your financial situation, how often you visit the doctor, your medication needs, and hospital requirements. Plans are categorized into Bronze, Silver, Gold, and Platinum, which determine how costs are shared between you and the plan.

4. What does ‘in-network’ and ‘out-of-network’ mean?

‘In-network’ refers to healthcare providers or facilities that have a business arrangement with your insurance company, often resulting in discounted rates. ‘Out-of-network’ means they do not have such an arrangement, and you may have to pay more.

5. Can I claim health insurance from both my and my spouse’s company?

Yes, if you both have medical claim plans, you may be able to coordinate benefits and claims from both insurance policies.

6. Will health insurance cover only surgery or all kinds of hospitalization expenses?

Health insurance typically covers a range of hospitalization expenses, not just surgery. This can include room charges, doctor fees, medical tests, and more.

7. Is there a guarantee that claims will be approved?

There is no absolute guarantee as claims are subject to the terms and conditions of the policy. However, if you follow the policy guidelines and submit the necessary documentation, your claim has a high chance of approval.

8. What should I consider before buying health insurance?

Consider factors such as the insurance premium, coverage limits, inclusions and exclusions, network hospitals, claim process, and customer service of the insurance provider.

9. How do I claim health insurance?

To claim health insurance, you need to submit a claim form along with necessary documents like medical bills, discharge summaries, and other relevant paperwork to the insurance company.

10. What are the reasons why your claim can be rejected?

Claims can be rejected for reasons such as non-disclosure of pre-existing conditions, seeking treatment for excluded ailments, incomplete documentation, or not following the claim process correctly.

These questions can help guide you through the process of understanding and choosing the right health insurance plan for you and your family. If you have any further questions or need assistance, please do not hesitate to contact us!

For more information and assistance, visit The Best Health Insurance Plans: Your Insurance Path – your guide to navigating health insurance with ease.

This article is designed to be engaging, informative, and SEO-friendly, ensuring that it resonates with readers while also helping the featured platforms rank well in search engines. If you require further customization or additional content, please let me know!